|

Symbol |

Price |

Date |

Sentiment |

Comment |

Chart |

|---|---|---|---|---|---|

|

28.98 |

31.13 28.32 |

June 28 July 12 |

Bearish |

6/28 Needs news. IBD article not powerful enough. 7/12 Tons of sell orders, not many takers. |

|

|

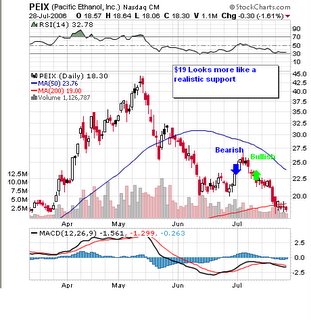

18.30 |

20.62 22.87 |

June 28 July 6 |

Bearish |

6/28 Ethanol out of favor short term. Cramer rings register. 7/6 Oil on rise due to global tensions, but a false rally |

|

|

10.37 |

12.13 10.66 |

June 28 July 12 |

Bearish |

6/28 Gains already priced in before earnings. Correction coming. 7/12 Correction has occurred. Be careful when shorting below $10. Wait for $11 - $12 before shorting again. Bullish above $12. |

|

|

15.85 |

15.37 18.85 |

June 28 July 12 |

Bearish |

6/28 Momentum shifting. Acomplia coming. 7/12 $20 is strong resistance. Short above $19, cover around $17. Great swing trade |

|

|

13.51 |

14.00 13.07 |

June 28 July 12 |

Bearish |

Lots of sell orders around $15. Stock is easily manipulated. |

|

|

23.37 |

28.10 26.68 |

June 28 July 12 |

Bearish Bearish |

Hexcel (HXL) bad news will affect. Hot sector cooling off as investors turn to mutual funds and cash |

|

|

30.65 |

31.00 33.00 |

June 28 July 12 |

Neutral Bullish |

Consolidating stage. May fall soon. Consolidation broken. Rally confirmed by volume. |

|

|

18.31 |

22.02 20.22 |

June 28 July 12 |

Bullish |

6/28 Oversold off neutral news- buying Intel's wireless business. Likely gap up 7/12 Gap up failed. |

|

|

BDCO 5.07 |

5.83 |

July 12 July 14 July 17 |

Bearish Neutral Bearish |

7/12 Cup and handle forming on oil news. If oil doesn't hold steadily above $75, short in a short time period. 7/14 Oil heading back to $75, but global oil jitters remain 7/17 Oil has reached $75 zone, and stock has dropped hard. Beware with shorting at this level. Short while oil is below $75, and stock is above $5 |

|

|

AAPL 52.37 |

58.97 |

June 29 July 17 |

Bearish |

Public not impressed with

computers. Needs iPod news. Stock is oversold heading into earnings |

|

|

VPRT 24.84 |

$28.82 | June 28 | Bearish | Heavy insider selling. |

|

|

HANS 44.77 |

47.15 | July 17 | Bearish | 4:1 split hype is over as buy orders moving down closer to sell orders. Looking for breakdown at next test of $48. |

|

|

ESCL 4.98 |

5.81 |

July 12 July 17 |

Bullish Neutral |

Go long below $5.50, with a target to $7.00. After main customer gets sued, Escala responded by showing they can get revenue from another source. 7/17 Volume drying up |

|

A list of momentum stocks and an updated sentiment table. These stocks are strong swing trading candidates. At the end of each month I post an updated chart that tracks my calls. This is for educational purposes only, and are not buy or sell recommendations.

Prices updated: Market close 7-28-2006